For many homeowners aged 55 and over, equity release offers a way to unlock the value built up in a home without needing to sell or move. Whether your goals include supplementing retirement income, supporting family, or planning for care costs, equity release is one of several regulated later-life lending solutions that can provide structured access to capital.

This overview explores how equity release works, who it may benefit, and the considerations to weigh as part of your long-term financial planning.

Equity release enables you to access some of the wealth tied up in your home while continuing to live there. There are two main product types, both regulated by the Financial Conduct Authority:

The most widely used equity release product. A lifetime mortgage allows you to borrow money against the value of your home, while retaining full ownership. No repayments are required unless you choose to make them. The loan, along with any accumulated interest, is typically repaid when you die or enter long-term care, and the property is sold.

A drawdown version allows you to take an initial lump sum and access further funds in stages. This can help reduce the total interest charged and give you greater flexibility over time.

This option involves selling part or all of your home to a provider in exchange for a tax-free lump sum. You continue to live in the property under a lifetime lease. While this structure provides certainty, it is generally less flexible and involves surrendering part of your ownership permanently.

Although still available, home reversion now represents a small part of the market. Most clients today opt for lifetime mortgages due to their flexibility, optional repayments, and ability to retain ownership.

Later life borrowing has evolved. Attitudes toward carrying debt in retirement are changing, and many now view property wealth as a financial asset that can be used during life, not only passed on after death.

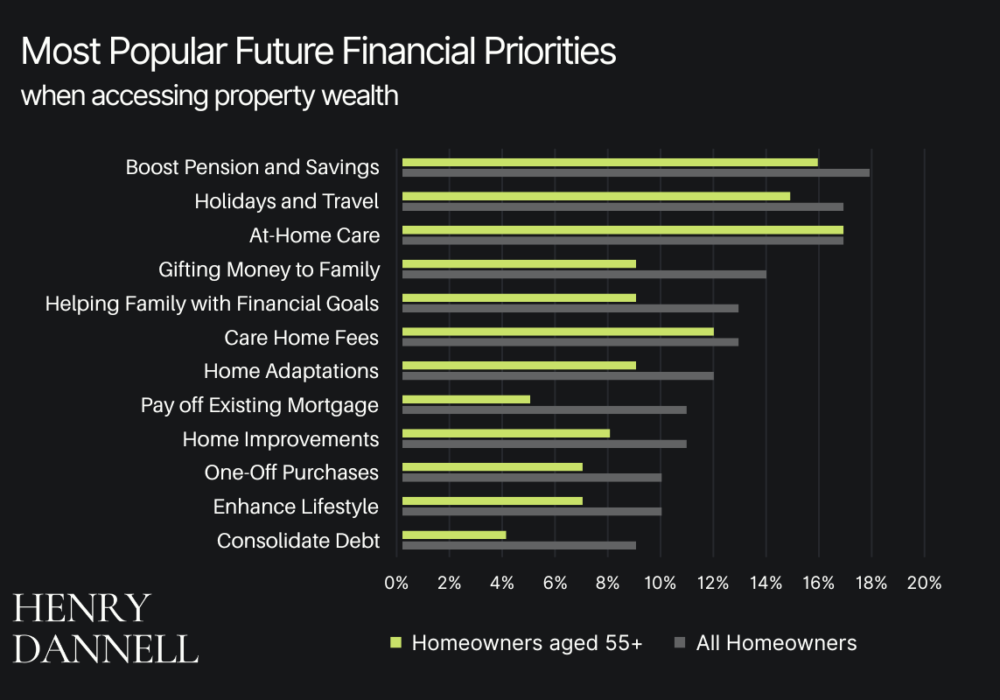

Recent data highlights this shift:

Regulatory safeguards, rising property values, and increased product innovation have all contributed to equity release becoming part of mainstream retirement conversations.

| Primary Motivations | Percentage of Homeowners |

|---|---|

| Paying for care at home | 17% |

| Supplementing retirement income | 16% |

| Funding holidays or lifestyle goals | 15% |

| Gifting a deposit to family | 14% |

| Gifting for other family needs | 13% |

Other frequent use cases include:

You remain the legal owner of your home and can access funds without the need to sell or downsize. This provides liquidity while maintaining your living arrangements.

Releasing equity reduces the value of your estate. In some cases, this may help reduce exposure to inheritance tax, particularly where funds are gifted and fall outside of the estate under Potentially Exempt Transfer (PET) rules. Always consult a tax adviser before proceeding.

Funds released can be used to:

All lifetime mortgage plans recommended by Henry Dannell meet the standards of the Equity Release Council, including a no negative equity guarantee. This means you will never owe more than the value of your home.

The amount depends on several key factors:

Enhanced plans may allow higher borrowing for individuals with certain health conditions. A personalised illustration will provide a clear view based on your profile.

Try our Equity Release Calculator to estimate your potential borrowing.

This is not a one-size-fits-all solution. While equity release can be valuable, it also has lasting implications. You should consider:

You should always discuss your plans with family or beneficiaries and seek guidance from an FCA-regulated adviser who can explain the full implications and explore other options.

Before proceeding, it’s important to assess all available routes. Your adviser can help you consider alternatives such as:

Equity release should only be chosen when it is the most suitable solution for your long-term goals.

Equity release can unlock property wealth to support your retirement, help your family, or improve your lifestyle, all without the need to move home. However, it will affect the size of your estate and could impact your entitlement to benefits.

With professional advice, a clear understanding of the risks and benefits, and a plan tailored to your circumstances, equity release can form part of a well-structured later life financial strategy.

To explore whether equity release is appropriate for you, speak to a Henry Dannell adviser for personalised, regulated advice and a full market review.

Please note: To understand the features and risks, always obtain a personalised illustration.

A mortgage is secured against your home. Your home may be repossessed if you do not keep up repayments on your mortgage or any other debt secured on it. Mortgage deals may not be available, and lending is subject to individual circumstances and status.